Forex trading is a popular and potentially lucrative endeavour that involves buying and selling currencies on the foreign exchange market. As a forex trader, it is crucial to have a deep understanding of the market dynamics and various techniques that can be employed to make informed trading decisions. One such technique is utilizing forex trading patterns. This article will explore the concept of forex trading patterns, their significance, and how you can effectively use them to enhance your trading strategies.

Introduction

In the world of forex trading, patterns play a vital role in identifying potential opportunities and predicting future price movements. These patterns are formed by the repetitive behaviour of market participants, resulting in recognizable chart formations. By understanding and utilizing these patterns, traders can gain insights into market sentiment and make informed decisions based on historical price action.

Understanding Forex Trading

Before delving into the intricacies of trading patterns, it is essential to grasp the fundamentals of forex trading. Forex, short for foreign exchange, refers to the decentralized global marketplace where currencies are bought and sold. To profit from fluctuations in currency exchange rates is the primary goal of forex trading. Traders speculate on the direction of currency pairs, aiming to buy low and sell high to capitalize on price differentials.

What is Forex Trading?

The simultaneous buying of one currency and selling of another is involved in forex trading.Currencies, such as EUR/USD or GBP/JPY, are always traded in pairs. The value of a currency pair represents the amount of one currency required to purchase another. Forex trading operates 24 hours a day, five days a week, allowing traders to react swiftly to market events and news.

Importance of Forex Trading

Forex trading holds significant importance in the global financial markets. It serves various purposes, including facilitating international trade, managing currency risk, and providing investment opportunities. The forex market is the most liquid and largest financial market globally, with trillions of dollars traded daily. This liquidity ensures ample trading opportunities, making forex an attractive market for traders worldwide.

Forex Trading Patterns

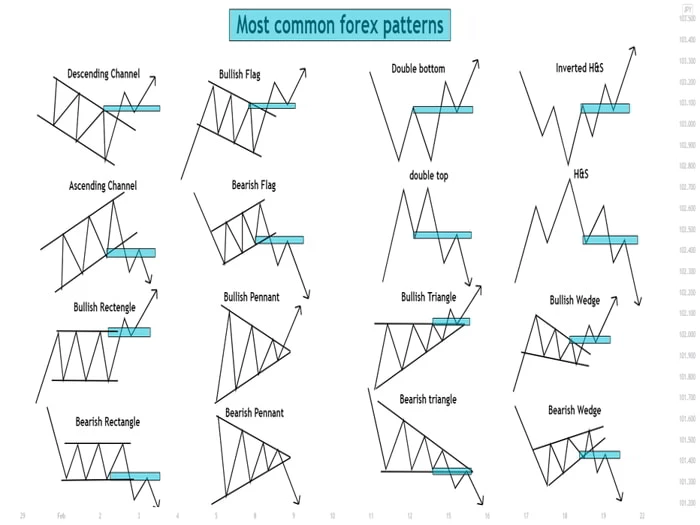

Forex trading patterns are visual representations of historical price movements that recur in the market. These patterns offer insights into the collective psychology of traders and the potential direction of future price movements. Traders use these patterns to identify entry and exit points, manage risk, and increase the probability of profitable trades.

Definition of Trading Patterns

Trading patterns, also known as chart patterns, are specific formations that appear on price charts. These formations provide information about the prevailing market sentiment and can signal potential trend reversals, continuations, or trend confirmations. The most commonly observed trading patterns include trend, reversal, and continuation patterns.

Trend Patterns

Trend patterns indicate the market's direction and are further categorized into uptrends and downtrends. Uptrends display a series of higher highs and higher lows, indicating a bullish sentiment. Downtrends, on the other hand, exhibit lower highs and lower lows, representing a bearish sentiment. Trend patterns can help traders identify the current market trend and adjust their strategies accordingly.

Reversal Patterns

Reversal patterns suggest an upcoming change in the prevailing trend. These patterns indicate the exhaustion of the current trend and the potential for a reversal in the opposite direction. Reversal patterns can allow traders to enter trades early and capitalize on trend reversals. Double tops, double bottoms, head and shoulders, and inverse head and shoulders are common reversal patterns.

Continuation Patterns

Indicate a temporary pause in the prevailing trend before it resumes, continuation patterns.These patterns suggest that the market is taking a breather, consolidating its gains or losses, before continuing in the same direction. By recognizing continuation patterns, traders can avoid premature exits and capitalize on the resumption of the underlying trend. Triangles, flags, and pennants are examples of continuation patterns.

Importance of Forex Trading Patterns

Forex trading patterns offer several advantages to traders. Firstly, they provide a structured approach to analyzing price action and understanding market dynamics. Patterns enable traders to identify potential entry and exit points, enhancing the precision of their trades. Additionally, these patterns offer insights into market sentiment and the behaviour of other traders, allowing traders to anticipate price movements.

Using forex trading patterns can help traders gain a competitive edge by minimizing emotions and relying on objective data-driven analysis. Patterns provide a framework for logical trading decisions based on historical price behaviour. By incorporating trading patterns into their strategies, traders can increase the likelihood of profitable trades and manage risk more effectively.

How to Use Forex Trading Patterns

To effectively utilize forex trading patterns, traders must follow a systematic approach that involves identifying, analyzing, and implementing the specified patterns. Here's a step-by-step guide on how to use forex trading patterns to enhance your trading strategies:

Identifying Patterns

The first step is to identify potential patterns on the price charts. Traders can use technical analysis tools and indicators to highlight possible formations. Traders can spot likely trading patterns by focusing on crucial support and resistance levels, trend lines, and candlestick patterns.

Analyzing Patterns

Once a pattern is identified, it is crucial to analyze its characteristics and implications. Traders should consider the historical significance of the pattern, its success rate, and the prevailing market conditions. Technical indicators and oscillators can provide additional confirmation or divergence signals, aiding the analysis process.

Implementing Patterns

After thorough analysis, traders can implement the identified patterns into their trading strategies. This involves determining the appropriate entry and exit points, setting stop-loss and take-profit levels, and managing position sizes. Traders should also consider incorporating risk management techniques to protect their capital.

By following this systematic approach, traders can harness the power of forex trading patterns and integrate them into their decision-making process.

Benefits of Using Forex Trading Patterns

The utilization of forex trading patterns offers several benefits to traders:

- Increased Precision: Trading patterns provide clear guidelines for entering and exiting trades, enhancing the precision of trading decisions.

- Enhanced Risk Management: Patterns allow traders to set appropriate stop-loss levels and manage risk effectively, safeguarding their capital.

- Objective Decision-Making: Patterns provide a data-driven approach to trading, minimizing emotional biases and promoting accurate decision-making.

- Anticipation of Price Movements: By recognizing patterns, traders can anticipate potential price movements and position themselves accordingly.

- Simplified Analysis: Patterns simplify the analysis process by providing visual cues and predefined rules, saving time and effort.

Examples of Forex Trading Patterns

To further illustrate the concept of forex trading patterns, let's explore a few common examples:

- Double Top: This reversal pattern occurs when the price forms two consecutive peaks of similar height, indicating a potential trend reversal from bullish to bearish.

- Head and Shoulders: Another reversal pattern, the head and shoulders formation consists of three peaks, with the middle peak being the highest. A shift from bullish to bearish sentiment is suggested by this pattern.

- Ascending Triangle: This continuation pattern is characterized by a horizontal resistance level and an upward-sloping support line. It suggests a potential continuation of an existing uptrend.

- Falling Wedge: A falling wedge is a bullish continuation pattern formed by converging support and resistance lines. It indicates a potential upward breakout from the pattern.

These examples highlight the patterns observed in forex trading, each providing valuable insights into market dynamics.

Best Practices for Using Forex Trading Patterns

To maximize the effectiveness of forex trading patterns, consider the following best practices:

- Combine Patterns with Other Technical Analysis Tools: While patterns are potent tools, combining them with other technical indicators can provide additional confirmation and increase the accuracy of trading signals.

- Validate Patterns with Multiple Timeframes: Analyzing patterns across different timeframes can help validate their significance and improve the overall reliability of trading decisions.

- Practice Proper Risk Management: Use appropriate position sizing, set stop-loss orders, and adhere to risk management principles to protect your trading capital.

- Keep Learning and Adapting: Forex markets are dynamic, and patterns may evolve or lose effectiveness over time. Stay updated with market trends, continuously educate yourself, and adapt your strategies accordingly.

- Backtest and validate: Before implementing patterns in live trading, conduct thorough backtesting to validate their effectiveness and understand their historical performance.

By following these best practices, traders can optimize their forex trading patterns and increase the likelihood of success.

Common Mistakes to Avoid

While using forex trading patterns, be cautious of the following common mistakes:

- Overreliance on Patterns: Although patterns provide valuable insights, it is crucial not to rely on them solely. When trading, consider other factors such as fundamental analysis, market sentiment, and news events.

- Ignoring Risk Management: Proper risk management techniques can prevent traders from significant losses. Always prioritize risk management and implement appropriate stop-loss orders.

- Neglecting Market Context: Patterns should be analyzed within the broader market context. Consider the prevailing trend, volatility, and fundamental factors that may impact the reliability of the pattern.

- Lack of Patience and Discipline: Trading patterns require patience and discipline. Avoid impulsive trading decisions and wait for confirmed signals before entering trades.

- Failing to Adapt: Market conditions change, and patterns may lose effectiveness. Continuously adapt your strategies and stay updated with market trends to avoid relying on obsolete patterns.

By avoiding these common mistakes, traders can enhance their trading performance and effectively utilize forex trading patterns.

Tools and Resources for Forex Trading Patterns

Several tools and resources can assist traders in identifying and analyzing forex trading patterns. Here are a few examples:

- Trading Platforms: Most trading platforms provide built-in charting tools and indicators that can help identify and analyze patterns.

- Technical Analysis Software: Dedicated technical analysis software offers advanced charting capabilities, pattern recognition scanners, and backtesting functionalities.

- Educational Materials: Various books, online courses, and webinars focus on forex trading patterns, providing in-depth knowledge and practical insights.

- Online Communities and Forums: Engaging with other traders in online communities and forums can facilitate knowledge-sharing and provide valuable insights into trading patterns.

- Market News and Analysis: Staying updated with market news, economic indicators, and technical analysis reports can enhance pattern recognition skills and validate trading decisions.

By leveraging these tools and resources, traders can stay ahead of the curve and effectively utilize forex trading patterns in their trading strategies.

Conclusion

Forex trading patterns offer a robust framework for understanding market dynamics and making informed trading decisions. By recognizing and analyzing these patterns, traders can identify potential entry and exit points, manage risk effectively, and increase the likelihood of profitable trades. However, it is crucial to combine pattern analysis with other technical indicators, practice proper risk management, and adapt strategies to changing market conditions. Continual learning, discipline, and patience are essential to successful pattern-based trading. Utilize the insights from trading patterns and leverage them alongside your analysis to enhance your forex trading performance.

FAQs

Q1: Can forex trading patterns guarantee profitable trades?

No, forex trading patterns do not guarantee profitable trades. They provide insights and probabilities based on historical price behaviour, but market conditions can change, leading to unexpected outcomes. Combining pattern analysis with other factors and exercising proper risk management is essential.

Q2: How long does it take to become proficient in identifying forex trading patterns?

The time it takes to become skilled in identifying forex trading patterns varies from individual to individual. It depends on factors such as dedication to learning, practice, and the complexity of the studied patterns. Continuous learning and hands-on experience will improve pattern recognition skills over time.

Q3: Can forex trading patterns be used in conjunction with fundamental analysis?

Yes, forex trading patterns can be used alongside fundamental analysis. Fundamental analysis examines economic indicators, news events, and other currency movement factors. Combining pattern analysis with fundamental analysis can provide a more comprehensive view of the market and enhance trading decisions.

Q4: Are forex trading patterns equally effective in all market conditions?

Forex trading patterns may vary in effectiveness depending on market conditions. Some patterns perform better in trending markets, while others excel in range-bound or volatile markets. It is crucial to consider the market context and adapt strategies accordingly.

Q5: Can complex technical indicators be used to identify forex trading patterns?

It is okay to use simple technical indicators to identify forex trading patterns. While technical indicators can provide additional confirmation, patterns can often be identified with essential tools such as trend lines, support and resistance levels, and candlestick patterns.

Admin

Admin